Branded drug companies have been abusing the patent system for decades. One of the reasons why their practices have gone unchecked for so long is because regulators, policymakers, and the public do not have easy access to data that provide a comprehensive picture of how pharmaceutical patenting actually works in practice and how it impacts drug prices.

In 2022, our team of scientists, practitioners, patent informatics and analytics experts, and IP attorneys spent three months searching for and analyzing thousands of patents on some of the top-selling prescription drugs in the U.S.

What we uncovered was shocking. Branded drug companies like Merck, AbbVie, and Bristol Myers Squibb routinely amass dozens, often hundreds, of patents on a single drug to create overlapping layers of patent protection. The drug companies then leverage this extended patent protection to increase the power of anti-competitive business tactics to extend monopoly control of a market, also known as their “market exclusivity.”

We uncovered 1,429 filed and granted patents on the 10 top-selling drugs in the U.S. and published them in a publicly-accessible database, The Drug Patent Book. We also published our methodology so that anyone could replicate these same results. Peer-reviewed studies published by JAMA and Yale have cited and confirmed the reliability of our findings that branded drug companies seek follow-on patents to extend their patent protection in order to lengthen their market exclusivity.

This level of transparency has never been brought to the U.S. patent system. Explore our database here or scroll down to see what we uncovered about America’s top-selling drugs.

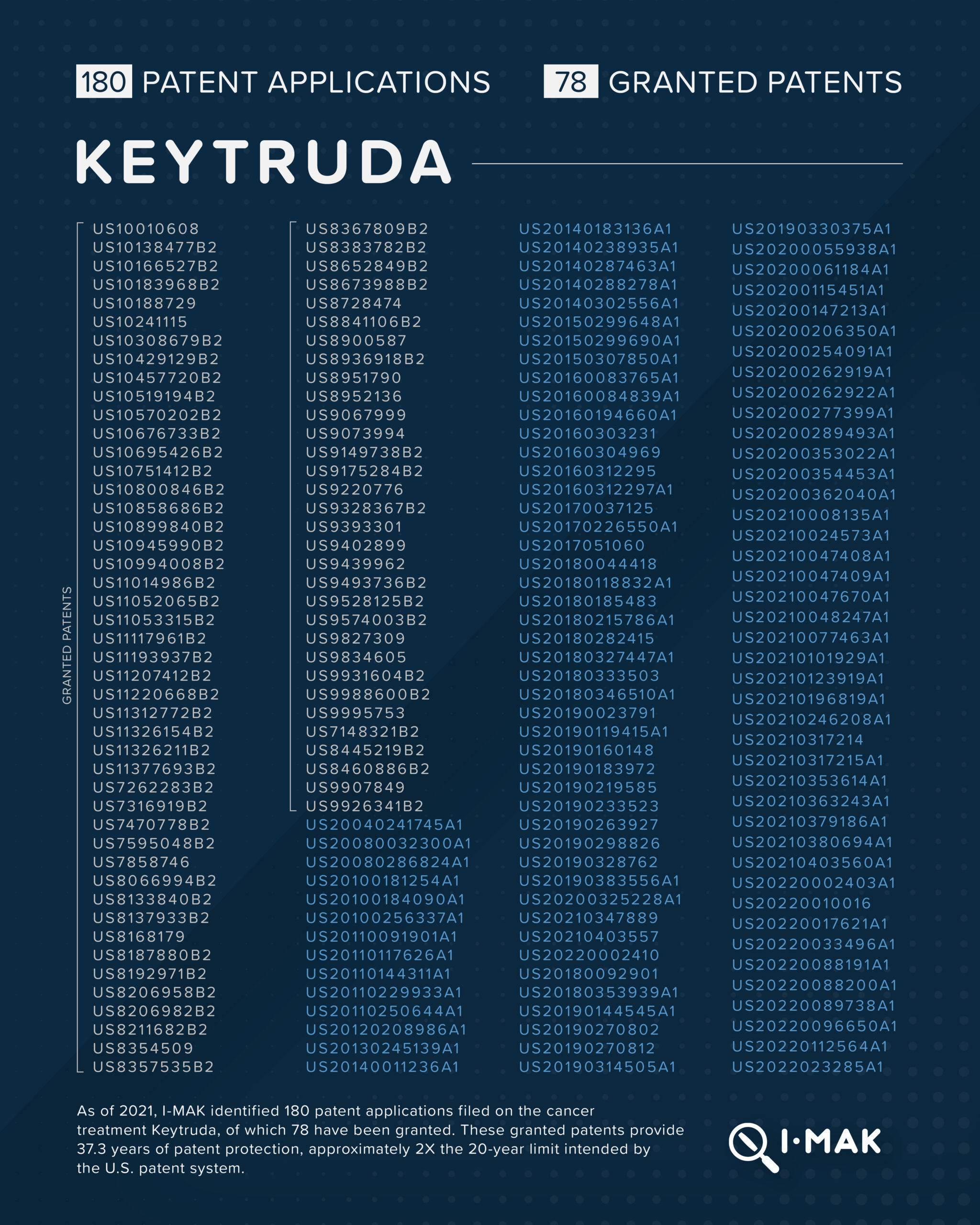

Keytruda, a cancer treatment that is marketed by Merck, carries a list price of over $200,000 per year. To date, 180 patent applications have been filed on Keytruda, 78 of which have been granted. These granted patents provide 37.3 years of patent protection, approximately 2X the 20-year limit intended by the U.S. patent system.

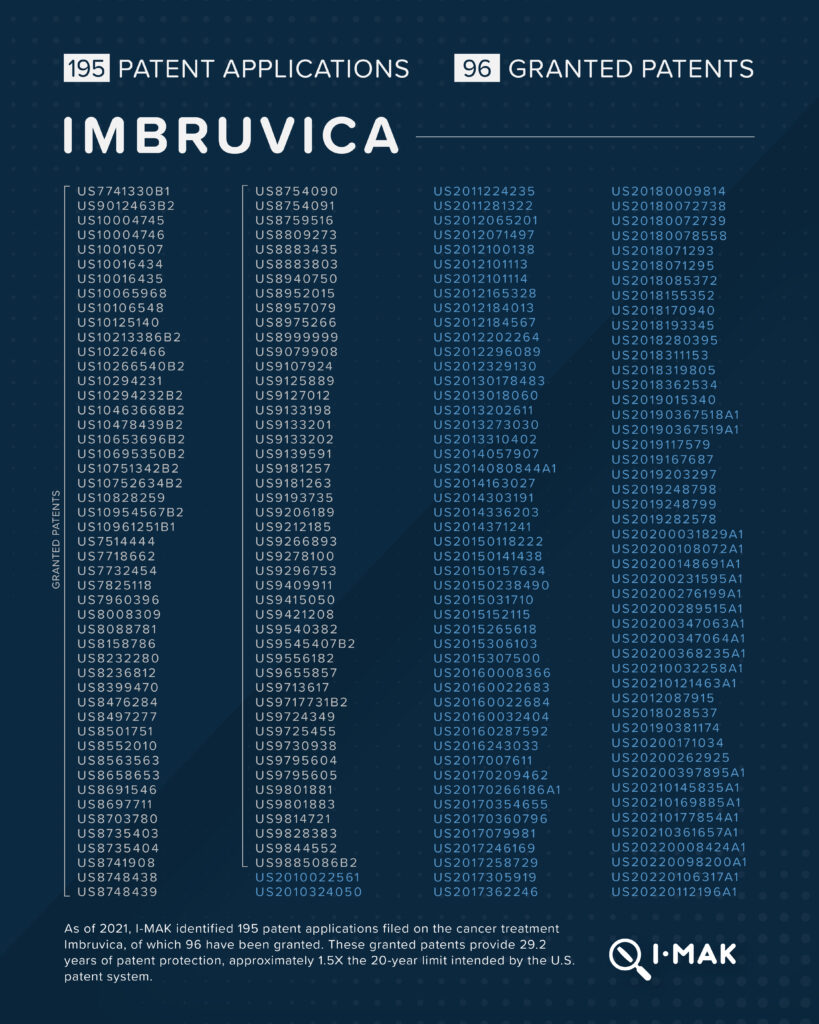

Imbruvica, a cancer treatment that is marketed by AbbVie, carries a list price of over $220,000 per year. 195 patent applications have been filed on Imbruvica, 96 of which have been granted. These granted patents add up to 29.2 years of patent protection, approximately 1.5X the 20-year limit intended by the U.S. patent system. A number of generic companies have settled litigation with AbbVie due to its patent thicket. They will not enter the market until 2032 at the earliest, giving AbbVie over five years of additional market exclusivity beyond the original patent term.

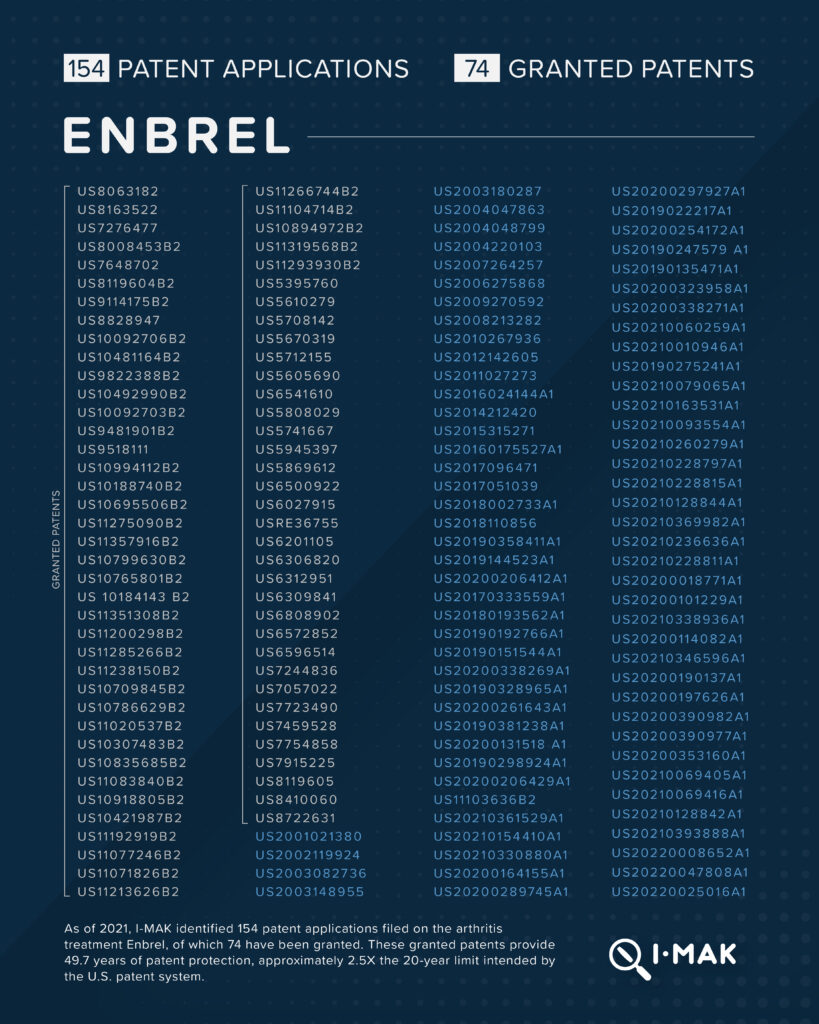

Enbrel, an arthritis treatment that is marketed by Amgen, carries a list price of over $100,000 per year. 154 patent applications have been filed on Enbrel, 74 of which have been granted. These granted patents provide 49.7 years of patent protection, approximately 2.5X the 20-year limit intended by the U.S. patent system.

Humira, an arthritis treatment that is marketed by AbbVie, carries a list price of nearly $90,000 per year. We identified 311 patent applications that have been filed on Humira, 165 of which have been granted. These granted patents provided 43.3 years of patent protection. AbbVie leveraged this extensive patent protection to extend its market exclusivity on Humira by 7 years, while extracting settlements and royalty payments before biosimilars entered the U.S in 2023.

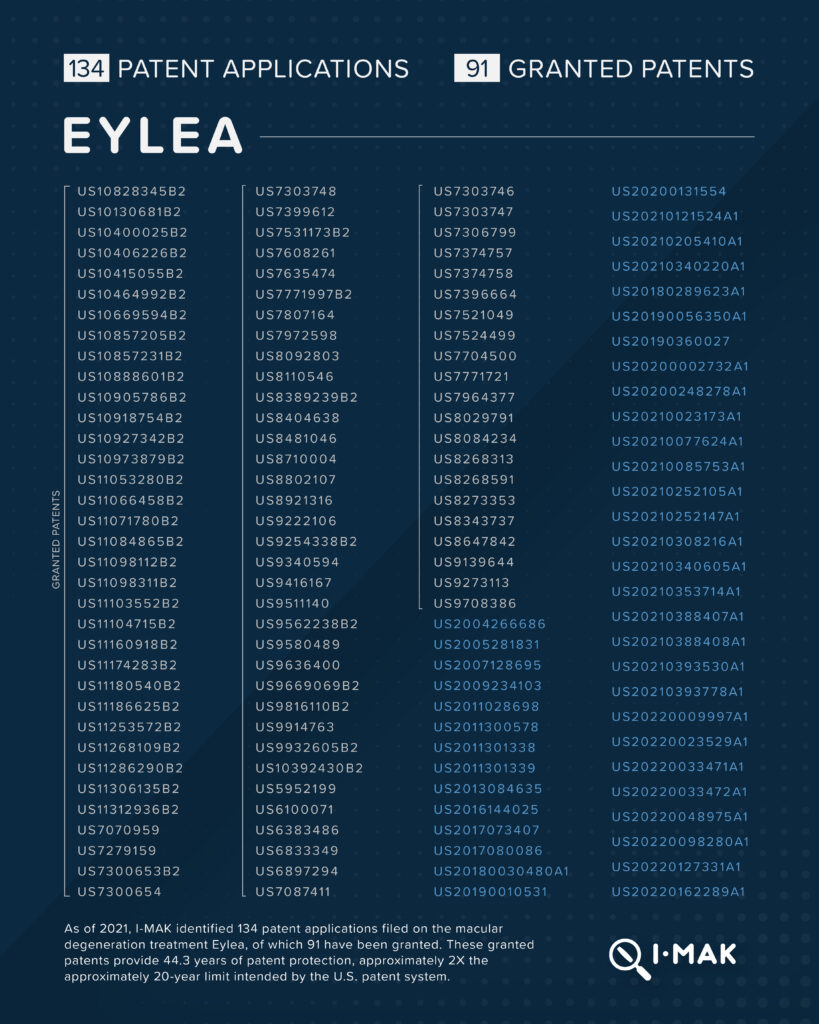

Eylea, a macular degeneration treatment that is marketed by Regeneron, carries a list price of approximately $17,000 per year. 134 patent applications have been filed on Eylea, 91 of which have been granted. These granted patents provide 44.3 years of patent protection, approximately 2X the 20-year limit intended by the U.S. patent system.

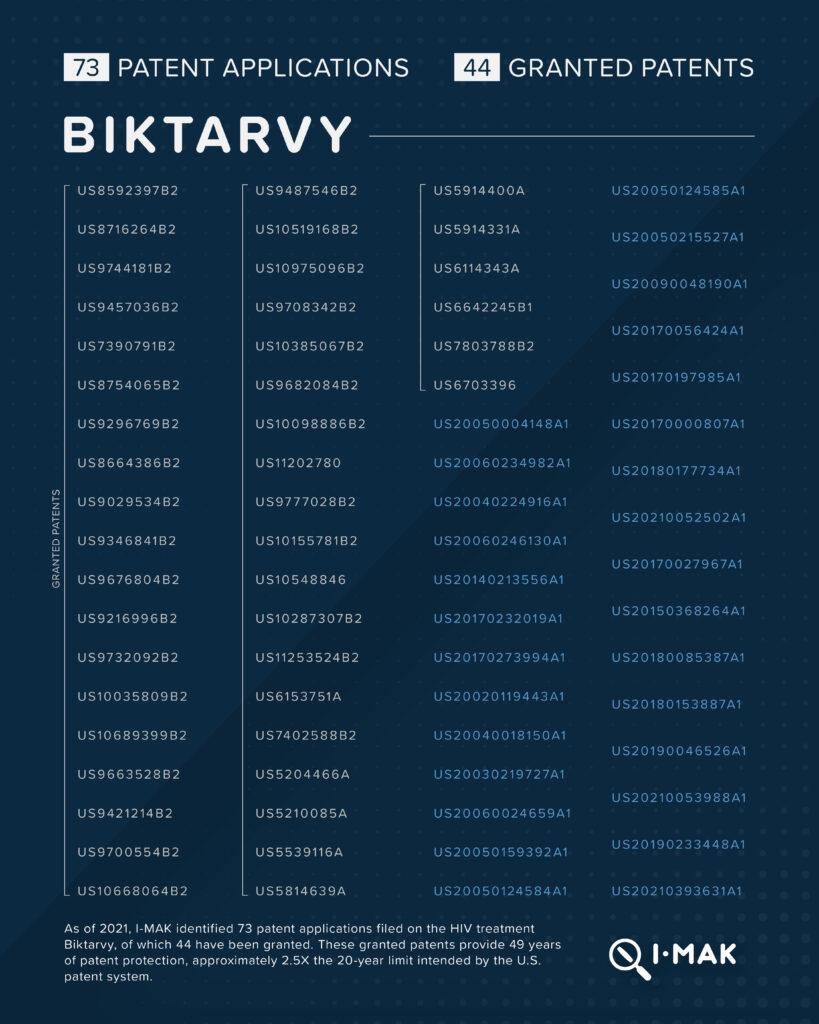

Biktarvy, a one-daily HIV treatment that is marketed by Gilead, carries a list price of approximately $50,000 per year. 73 patent applications have been filed on Biktarvy, 44 of which have been granted. These granted patents provide 49 years of patent protection, approximately 2.5X the 20-year limit intended by the U.S. patent system.

Revlimid, a cancer treatment that is marketed by Bristol Myers Squibb, carries a list price of approximately $18,000 per cycle (given every 28 days). 206 patent applications have been filed on Revlimid, 117 of which have been granted. These granted patents amount to 42.9 years of patent protection, approximately 2X the 20-year limit intended by the U.S. patent system. They have been used to block unlimited generic entry until January 2026, providing up to nearly 6 years of extra market exclusivity.

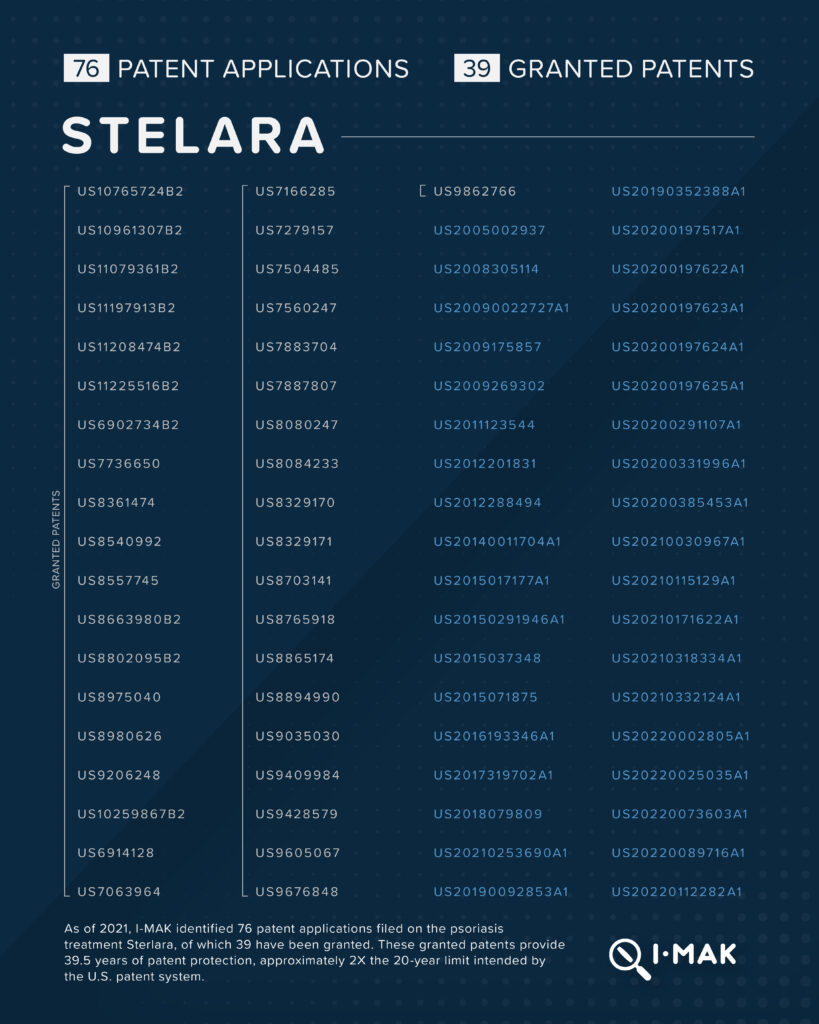

Stelara, a psoriasis treatment that is marketed by Johnson & Johnson, carries a list price of approximately $80,000 per year. 76 patent applications have been filed on Stelara, 39 of which have been granted. These granted patents amount to 39.5 years of patent protection, approximately 2X the 20-year limit intended by the U.S. patent system. Johnson & Johnson has been able to use its additional patents to carve out an additional two years of market exclusivity before Amgen’s biosimilar entered at the beginning of this year, with others to follow.

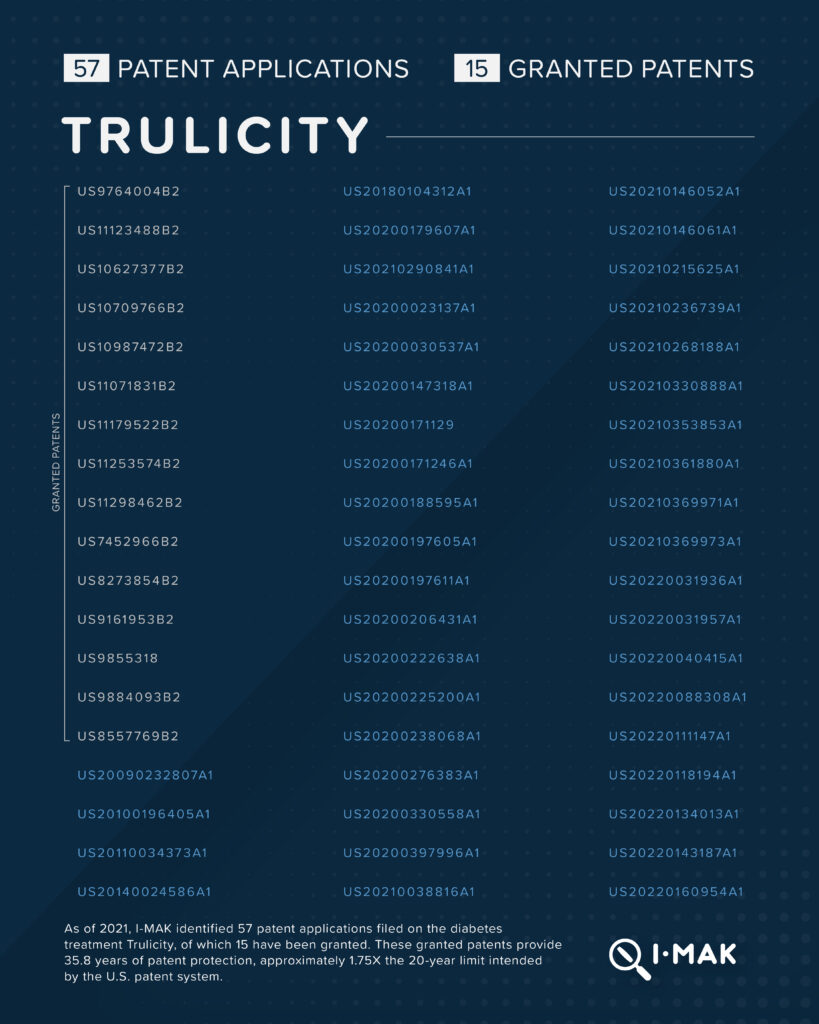

Trulicity, a type 2 diabetes medicine that is marketed by Eli Lilly, carries a list price of approximately $12,000 per year. 57 patent applications have been filed on Trulicity, 15 of which have been granted. These granted patents provide 35.8 years of patent protection, approximately 1.75X the 20-year limit intended by the U.S. patent system.

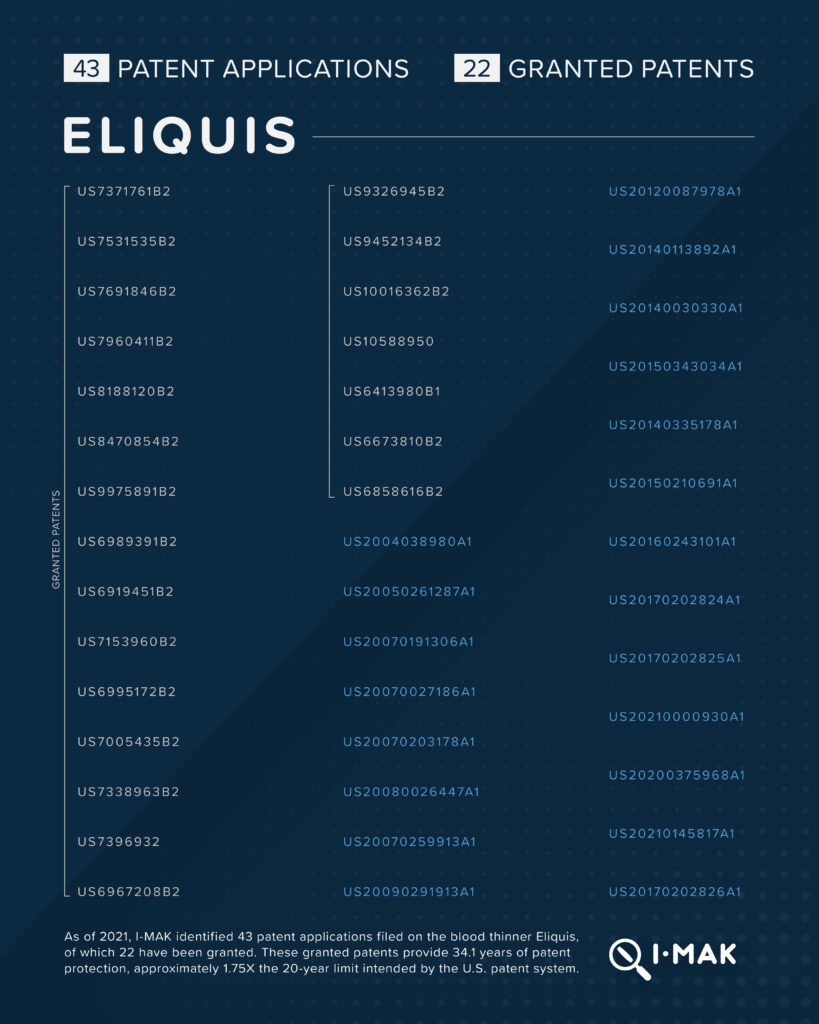

Eliquis, a blood thinner that is marketed by Bristol Myers Squibb, carries a list price of approximately $7,000 per year. 43 patent applications have been filed on Eliquis, 22 of which have been granted. These granted patents provide 34.1 years of patent protection, approximately 1.75X the 20-year limit intended by the U.S. patent system. In Europe, Bristol Myers Squibb’s market monopoly on Eliquis ended in 2022. In the U.S., thanks to additional patents, Bristol Myers Squibb is expected to extend its market monopoly until at least 2028—over 8 years after Eliquis’s primary patent expired and over 6 years later than Europe.