EXECUTIVE SUMMARY

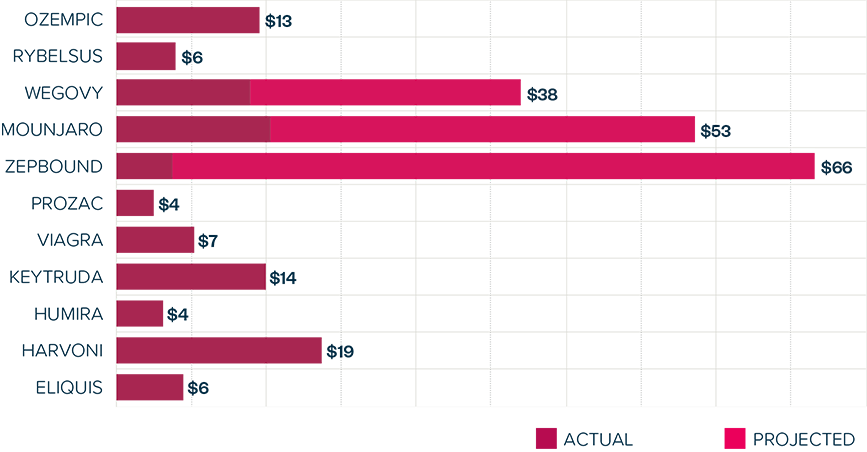

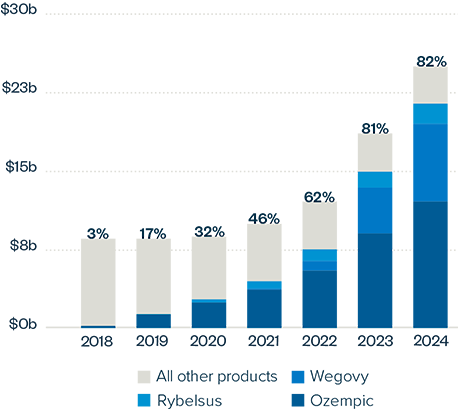

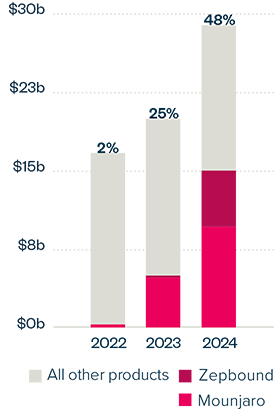

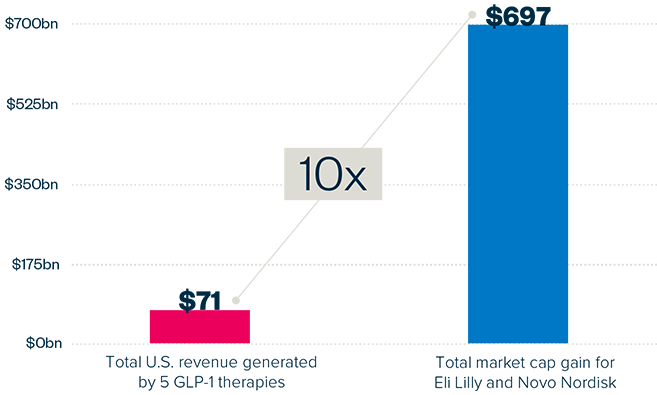

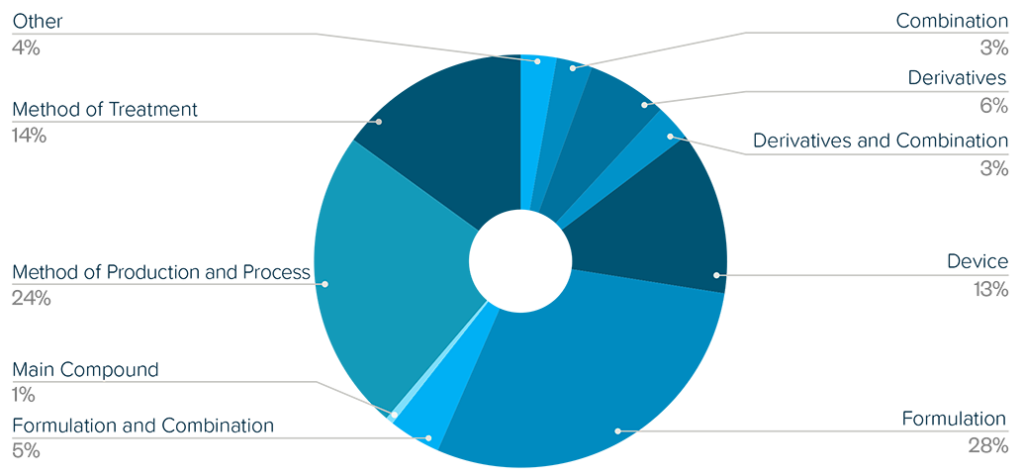

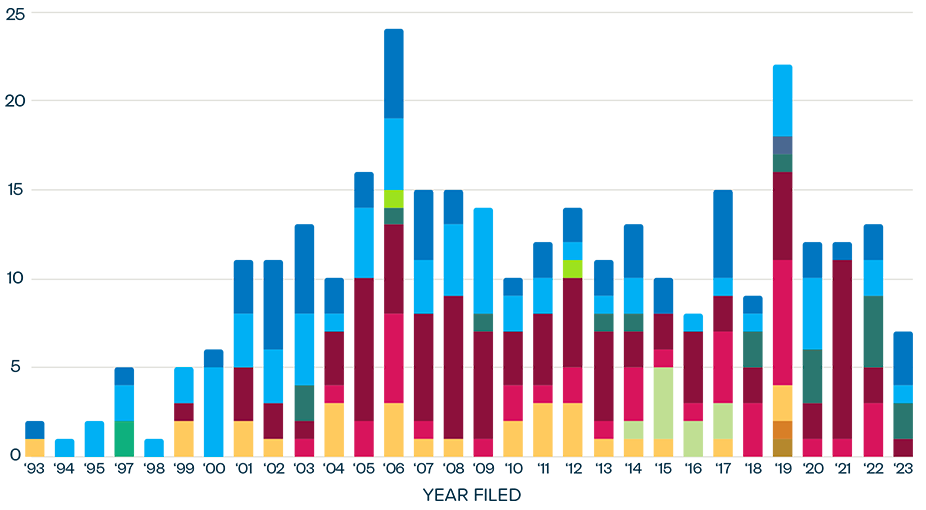

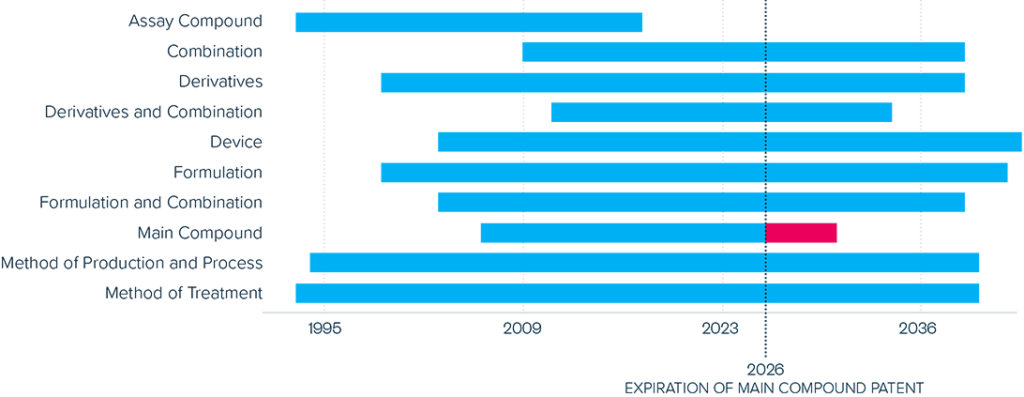

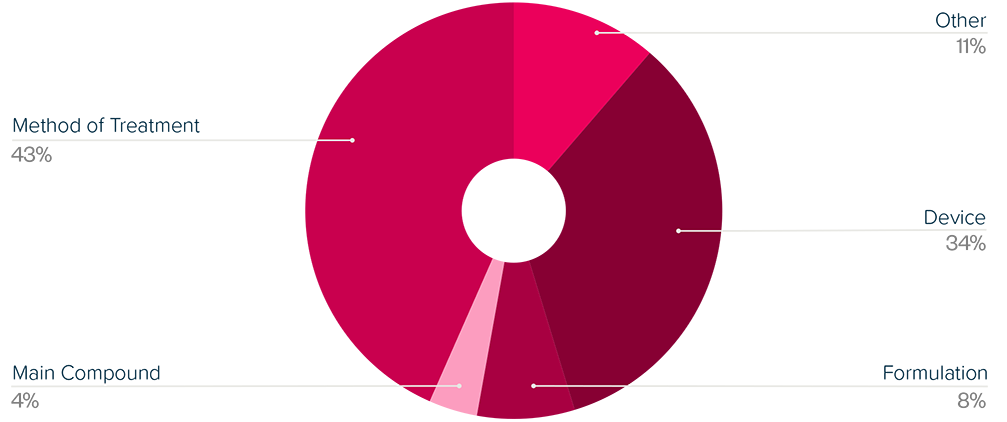

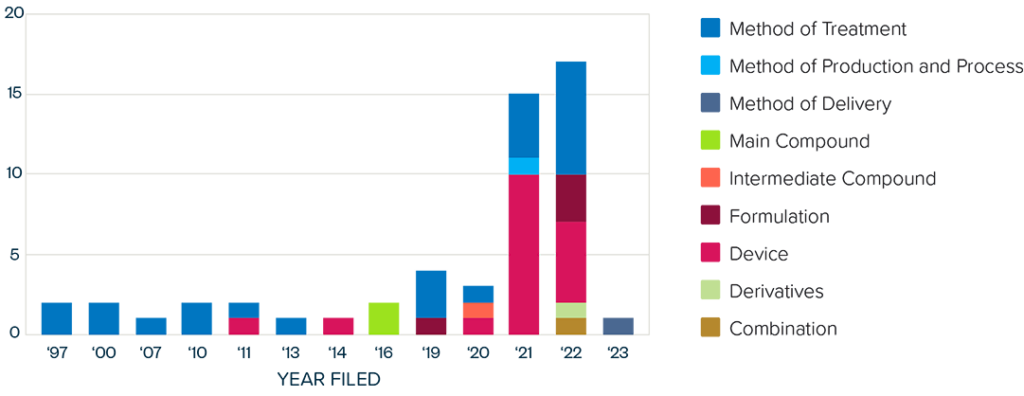

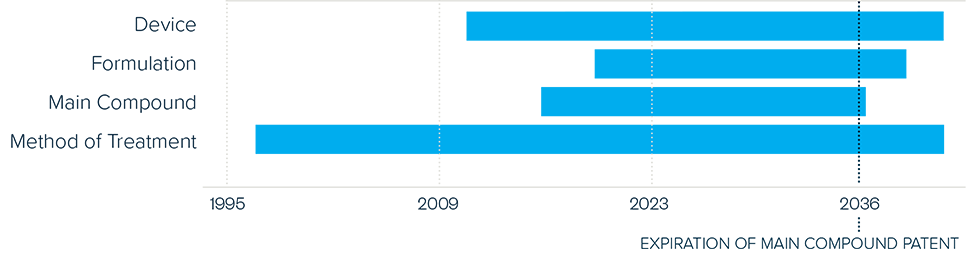

This brief examines the financialized business model of Novo Nordisk and Eli Lilly for the leading GLP-1 products Ozempic, Rybelsus, and Wegovy (semaglutide) and Mounjaro and Zepbound (tirzepatide). It shows how these companies are using the patent system as a key tool to maximize revenues, profitability, and shareholder returns. Through the creation of patent thickets, which includes filing and being granted follow-on patents for minor modifications, these companies have already extended their patent protection far beyond the term of the original patents for these products. By extending their patent protection through these follow-on patents, subject to the outcome of litigation and the terms of any settlements, they potentially stand to extend their market monopoly and increase revenues. This brief highlights how the financialized business model perpetuates health inequities that will disproportionately impact Black Americans and other marginalized populations who face higher rates of obesity and diabetes yet remain underrepresented in access to GLP-1 therapies. It also makes several recommendations for systemic reforms to the patent system to counter the influence of financialization that incentivizes patent abuse, as well as healthcare policies to address these inequities and promote affordable access to these life-changing treatments.